Did you know that more than 1 in 5 (21.8%) of Canada’s working-age population is close to retirement, that is, aged 55 to 64[1]? Never before has this number been so high.

PORTRAIT OF OUR CLIENTS – FUTURE RETIREES (part 1)

Increased life expectancy

Not only are there more and more people near retirement, but their life expectancy is also increasing. Here are some facts. Since 2016, there are now:

- 8% more people in Canada that are age 85 and older, with 15.9% of them being age 100 and older.

- Over the next 30 years, the number of persons age 85 and older could triple from 861,000 to 2.7 million[2].

Top three concerns about retirement finances

Retirement is a major life event for most people and can cause some uncertainty. According to an RBC survey[3], the top three concerns of Canadians 55 and older are:

- Having enough savings (36%)

- Maintaining standard of living (31%)

- Impact of inflation (34%)

According to the same survey, only 53% of people age 55 and over say they have a plan.

Having enough savings and maintaining standard of living

These concerns often stem from the fact that future retirees don’t have an overview of their needs and finances. It is therefore in your interest to support them so that they can see things clearly.

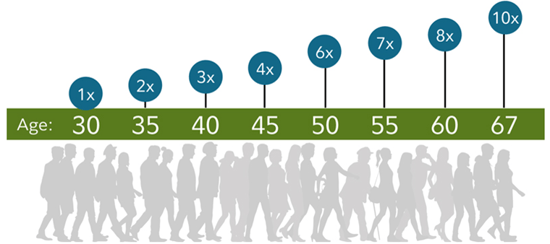

In terms of necessary savings, Fidelity Investments[4] offers a savings factor guide that suggests the “magic retirement number” should be ten times the final salary, and to achieve this, your client should aim to have:

- At age 30: one year's salary saved

- At age 40: three times the salary saved

- At age 50: six times the salary saved

- At age 60: eight times the salary saved

- At age 67: ten times the salary saved

This rule of thumb is not perfect since every retiree is different, but it has the benefit of serving as a wake-up call.

Coping with declining markets through a longer time horizon?

Clients approaching retirement may also face investment losses due to recent market volatility and reduced purchasing power due to high inflation. However, as the time horizon gets longer, staying invested is still the right thing to do.

In fact, even at this point in the crisis, they should continue to consistently invest small amounts, either through systematic savings or through dollar cost averaging (DCA).

To add to your retirement discussion with your client, feel free to share the my-retirement.ia.ca link in advance.

iA is here to support you!

In the next Did you know article, we will address the consolidation of assets for new retirees and the importance of establishing a disbursement plan.

Finally, several initiatives will be deployed in the Fall to support you, create additional contact opportunities with your clients and reassure them about their choice of institution and product.

Stay tuned!

[1] Source: Statistics Canada, The Daily, April 2022

[2] Source: Statistics Canada, The Daily, April 2022

[3] Source: RBC, 2022 Financial Independence in Retirement Poll

[4] Source: Fidelity Brokerage Services LLC