Did you know that the pioneer of the quantitative investment strategy, also known as multi-factor investing, was Louis Bachelier, a French mathematician whose doctoral thesis was published in 1900? [1]

What is quantitative investing?

A quantitative investment strategy, also known as a multi-factor strategy, is derived from an advanced mathematical model developed by industry professionals including programmers, statisticians and investment analysts.

Today, the advent of networked communications and powerful, inexpensive computers has paved the way for complex computerized mathematical models to guide investment decisions.

________________________________________

Stay tuned for the IN YOUR INTEREST podcast

which will address this topic very soon!

________________________________________

The objectives of quantitative investing are to:

- Identify stocks with a higher probability of outperforming an index using a broad range of characteristics

- Identify and invest in stocks that offer exposure to multiple return factors to enhance performance potential and diversify risk (increase risk/return ratio) in a variety of market environments

- Reduce human bias in the investment process

- Use data and technology to overcome human limitations

- Enable a scalable strategy (analysis of thousands of companies) and transposability (various universes and assets)

Quantitative strategy to benefit iA Investment Management Inc. (iAIM) global and international funds

iAIM’s team takes an active, quantitative approach to multi-factor investing for the following segregated funds:

- Global Equity

- Global Equity Hybrid 75/25

- Global True Conviction

- International Equity

"We believe that active, quantitative multi-factor investing can significantly enhance a portfolio’s diversification characteristics and performance potential."

— Sébastien Vaillancourt, iAIM

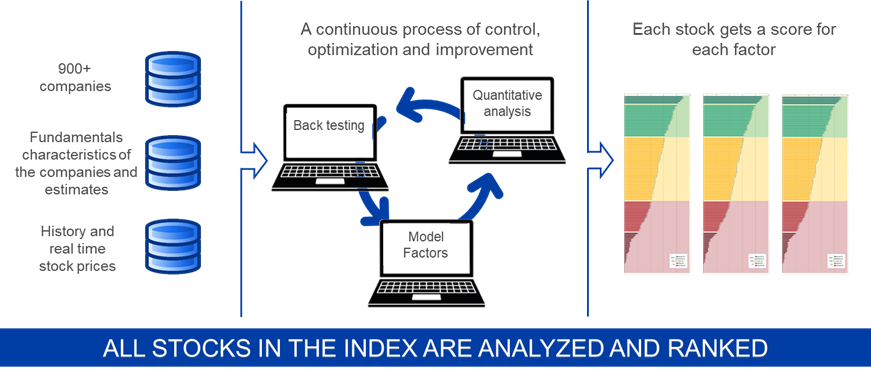

The multi-factor investment process at iAIM

The team's rigorous methodology incorporates multiple research sources, tools and techniques to determine factor selections.

- The team seeks to maintain a low correlation between the factors selected.

- Once the factors are selected, the team ranks all stocks in the 900+ EAFE index (Europe, Australasia and Far East index) from best to worst based on the score for all the different factors. A multiplier is also applied to this score based on the market capitalization of each stock in order to orient the portfolio towards the most liquid stocks.

- A risk management step is also used to reduce certain regional and sector/industry risks.

Grouping factors into three themes

Factors are attributes that determine returns. They are derived from strong economic logic.

There are over two dozen factors (e.g. profitability, liquidity, growth, price fundamentals, volatility, earnings, etc.) grouped under three main themes:

|

MOMENTUM

|

QUALITY

|

VALUE

|

A continuous process

The process is continuous and active to ensure that the portfolio and the factors used are optimized for the current market environment.

Regardless of the degree of automation in the investment process, the portfolio manager constantly reviews the model to reassess its ability to generate excess returns.

iAIM's quantitative investment team

Sébastien Vaillancourt and Matthew Kurbat are supported by a team of analysts dedicated to iAIM's global and international mandates.

Portfolio Manager

Sébastien Vaillancourt, MSc, CFA

Sébastien Vaillancourt, MSc, CFA

Senior Director, Portfolio Manager, Quantitative Equities

- More than 20 years in the industry

- More than 20 years with iA

- MS, Université du Québec à Trois-Rivières

Research Leadership

Matthew Kurbat, PhD, MBA, CFA

Consultant, Research Leadership

- More than 20 years in the industry

- 1 year as consultant for iAIM

- PhD and MS, University of Michigan

Financial Analysts

Emmanuel Brousseau, MSc, CFA

Senior Analyst, Quantitative Equities

- 6 years in the industry

- 5 years with iAIM

- MS, Financial Engineering, Laval University

Karl Demers-Bélanger, M. Sc.

Karl Demers-Bélanger, M. Sc.

Senior Analyst, Quantitative Equities

- 3 years in the industry

- 3 years with iAIM

- MS, Financial Engineering, Laval University

Félix St-Laurent, M. Sc., CFA

Senior Analyst, Quantitative Equities

- 4 years in the industry

- 4 years with iAIM

- MS and BA, Laval University

[1] Louis Bachelier, 1900, “The Theory of Speculation”, Paris-Sorbonne University.