Did you know that your clients’ emotions can seriously compromise the long-term performance of their savings?

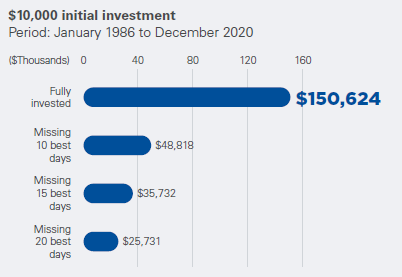

Here’s an example for an investor who invested $10,000 in 1986 and missed the 10 best days on the stock market over the last 35 years.*

This investor would have $100,000 less in their portfolio in 2020 than if he or she had stayed invested during periods of decline or volatility!

Just goes to show that an impulsive pullout can be costly!

With the increase in inflation and the volatility seen on the markets lately, your clients may make spontaneous decisions about their investments.

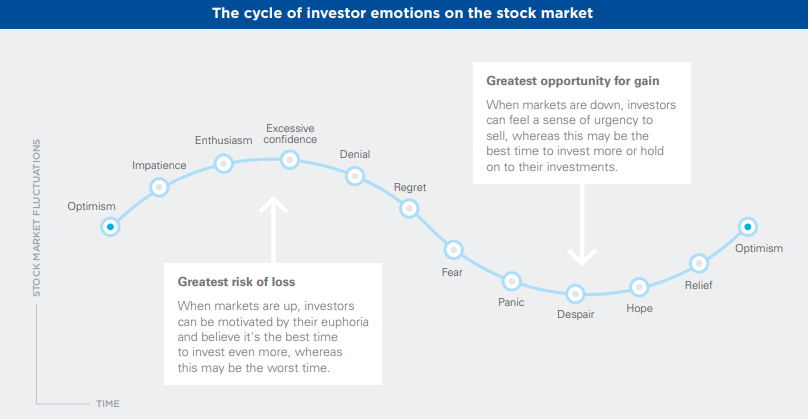

If any of them contact you to discuss their concerns, don’t hesitate to review with them the document Enter, exit or stay put? It will help you show them:

- The cycle of investor emotions

- The advantages of staying invested over the long term

*Source: Refinitiv, S&P/TSX Composite Index total returns from January 1, 1986, to December 31, 2020. Past performance is no guarantee of future results.