Do you have wealthy clients looking to maintain the same lifestyle in retirement with a tax-efficient strategy?

Did you know that the insured retirement strategy is an attractive option for:

- Clients who have already maximized their RRSPs and TFSAs, and are looking for a source of asset diversification

- Business owners who want to benefit from a financial lever in order to generate a retirement income

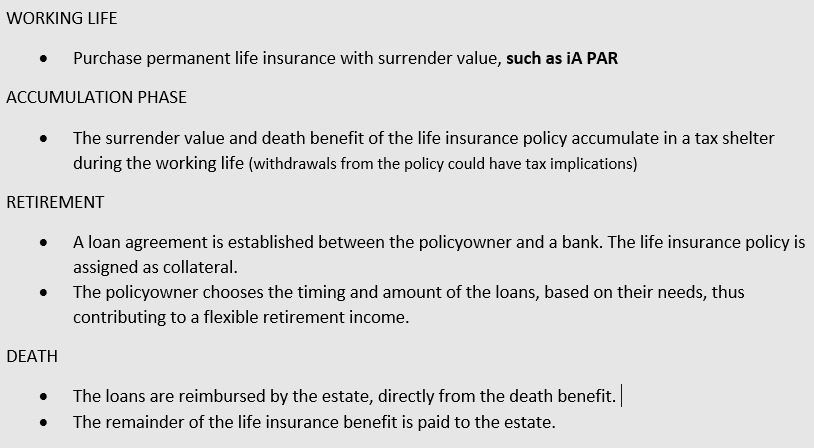

This strategy combines the benefits of permanent life insurance with a surrender value with the possibility of having the necessary liquidity to generate a flexible retirement income.

The four steps of the strategy

iA PAR is the perfect choice for such a strategy, thanks to the long-term growth of the death benefit and surrender value!

A tax-efficient strategy

Your client benefits from a reduction in income taxes to pay, since the revenues generated in a life insurance policy and the growth of the surrender value are not taxable.

Thanks to these tax savings, a life insurance policy grows at a faster annual rate than other types of investment (e.g. non-registered investments).

Discuss this strategy with your clients today!

The Insured Retirement Strategy – Sales Concept (F13-1094A) document has been designed to help you discuss this strategy with your clients.

The insured retirement strategy depends upon the fulfilment of certain tax-related conditions. For your high-net-worth clients who require more complex financial strategies, you can rely on the expertise and personalized guidance of our iA Advanced Case Solutions team.