As you know, clients with an RRSP, a locked-in RRSP or a LIRA contract must convert their contracts to a retirement income contract (RRIF or LIF) before the end of the year in which they turn 71.

Commission for requests received before December 1

This year, conversion requests for your clients who have reached the age limit must be made before December 1, 2022. A 1% commission on eligible investments (see the commission schedule) may be paid to you if your request is made before this deadline. Beyond the 1% commission, RRIF conversion is an excellent opportunity to review your clients’ retirement planning and work on consolidating their assets.

- A void personal cheque must be attached to the conversion form (F12A).

- If the annuitant wishes to use his or her spouse’s age to calculate the minimum withdrawal, you must also attach proof of age.

Don’t miss this opportunity to show your clients the value of your expertise!

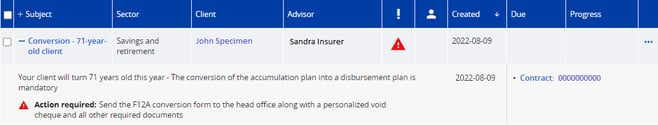

Important information in the Business Tracker

To make your life easier, an event was added to your Business Tracker for each of your clients who will turn 71 this year.

There is also a downloadable Excel list in Advisor Centre (My clients – Obtain your clients’ investment data – 71-year-old clients).

Conversions after December 1

If no conversion is made before December 1, 2022, RRSP, locked-in RRSP and LIRA contracts will be automatically converted to RRIF or LIF contracts with the annual payment option on December 15:

- Annual minimum;

or

- Lifetime surrender amount (LSA) for contracts invested in Guaranteed Surrender Series funds, Ecoflextra Series funds or the Income Stage of the FORLIFE Series.

RRSPs with less than $3,000 will be surrendered after December 1, 2022. Cheques will be sent to clients.

Questions?

- 1-844-442-4636

- savings@ia.ca