Starting March 18, a new actively managed investment account, the Smoothed Return Diversified Account (SRDA), will be available in Genesis 9 Universal Life.

The SRDA is a beneficial alternative to fixed income investments and ideal for clients with a long-term investment horizon, looking for estate protection upon death. Offer your clients exposure to a diverse range of asset classes, including a target of 50% in alternative assets, combined with low volatility thanks to smoothed returns. Note that surrenders, withdrawals and transfers to other investment accounts may be subject to a market value adjustment (MVA).

Five great features of the SRDA:

Five great features of the SRDA:

- A net credited rate of 3.25% for 2022, thanks to a low MER of only 1.25% (credited rate determined annually and credited monthly)

- Low volatility - maximum target annual variation of credited rate: 0.5%

- Minimum net credited rate of 0%: guaranteed capital protection

- A cruise-control investment option for your clients, actively managed by iAIM

- Access to asset classes generally reserved for the institutional market.

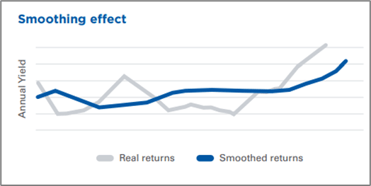

Smoothed returns

The credited rate of the SRDA is based on returns earned on the underlying fund assets, to which a smoothing formula is applied.

This formula spreads out gains and losses and offers stable, low volatility returns from year to year.

Who can benefit from the new SRDA?

The addition of the SRDA enhances the range of investment options available in Genesis and adapts to the changing needs of clients according to their risk profile and life stage:

- Clients with a low to moderate investor profile seeking an alternative to level costs. Invested in the SRDA, a Genesis policy with YRT costs favours accumulation and allows clients to benefit from flexibility of deposit while maintaining their policy over the long term.

- Transferring to the SRDA as they approach retirement allows clients to protect their accumulation and enjoy long-term stability while maintaining return potential.

The SRDA is also a great option for those looking to benefit from the Insured Retirement Strategy (IRS).

Good to know

- Compensation for the SRDA is the same as that for other accounts.

- The SRDA is not eligible for the investment bonus.

- A market value adjustment (MVA) may apply to withdrawals, surrenders or transfers from the SRDA to other investment accounts. However, it does not apply when paying costs of insurance charges, or in case of death or disability.

- The SRDA is an eligible account for policy loans.

Client communication

We are legally obliged to inform current Genesis 9 policyholders of the addition of the SRDA. Check out your marketing toolbox to see a copy of the letter and endorsement that will be sent to clients in the week of April 4th.

To download a list of your clients who have a Genesis 9 policy, go to the Advisor Centre:

- Click on the My Clients tab

- In the menu on the left of the screen, click In-force contracts download

- Click Search, then Submit when prompted

- Your report will appear within 48 hours in the Advisor Centre secure messaging module.