Did you know that on the same date just one year ago (August 8, 2021), the Guaranteed Interest Fund (GIF) rate for the 1-year term was 0.65% and is now 3.25%, and the High Interest Savings Account (HISA) rate was 0.40% and now stands at 2.35%?[1]

Opportunities to seize!

Beyond the recent market decline, the rise in interest rates has had a positive effect on the returns of GIFs and the HISA. In this context, these options offer enviable security often sought after in times of market volatility.

Showcase the common benefits of our GIFs and the HISA:

- Competitive rates. For rates in effect, click here.

- Capital 100% guaranteed.

- Can be redeemed at any time[2], unlike some banks’ GICs.

- No management fees.

To learn more, click here.

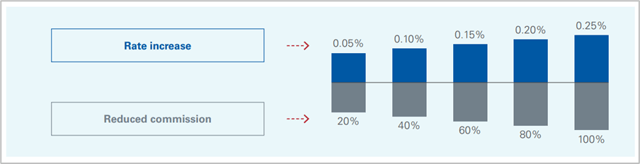

Did you also know that you can reduce your commission to pass along a better rate to your client?

To do so, simply use form F51-153A-1 and add a special instruction (section D) in which you mention the reduced commission rate.

In addition, don’t forget to add in the special instructions if your client already holds GIFs with iA. With an invested total amount of more than $24,999, your client will benefit from higher-tier rates based on this total amount. For rates in effect, click here.

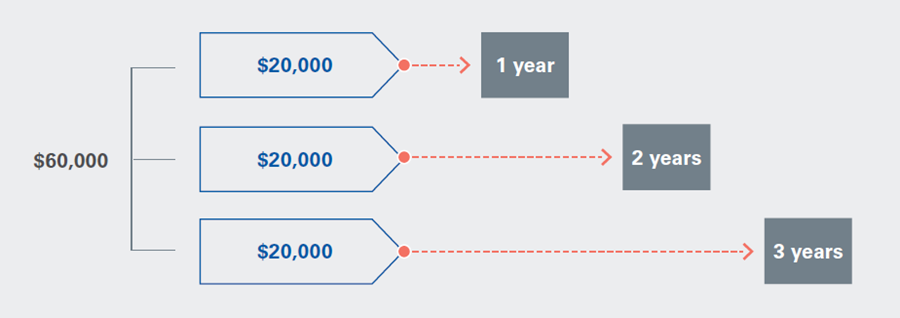

The benefits of the 3-year investment laddering strategy

By simultaneously investing three separate amounts in GIFs with respective terms of 1, 2 and 3 years, this strategy lets you anticipate your client’s future liquidity needs while providing optimal returns year after year.

- Better risk management related to interest rates

In the event of falling interest rates, only a portion of the capital is exposed at renewal. Conversely, if rates were to rise, the 1-year term, for example, could rapidly benefit from an increased rate at renewal.

- Higher long-term return rates

Long-term investments typically generate higher returns than short-term investments.

- Cash flow every year

Each year, liquidity becomes available to re-enter the markets, for example with the Dollar Cost Averaging (DCA) strategy or to contribute to an RRSP and a TFSA, or simply continue the laddering strategy!

Advantages all around!

[1] Rates are reviewed weekly and are subject to change without notice. Minimum deposit of $500 on GIFs.

[2] Fees may apply.